Background

For those participating in Medicare Shared Savings Program Accountable Care Organizations (MSSP ACOs) with the Centers for Medicare and Medicaid Services (CMS), the requirements for reporting to the Quality Payment Program (QPP) can be confusing. There are ACO requirements as part of MSSP participation. And then there are QPP requirements for being a Medicare Part B billing provider under the Medicare Access and CHIP Reauthorization Act of 2015 or MACRA. Although CMS has attempted to simplify reporting requirements across different models, the overlap between the requirements can be clunky and uncertain.

MSSP Reporting Requirements v. MIPS Reporting Requirements

The MSSP ACO program by regulation has certain participation and reporting requirements. These include the annual submission of quality measures via the Web Interface Reporting Mechanism and/or electronic Clinical Quality Measures (eCQMs) or MIPS CQMs. The number of measures required to report depends on which mechanism the ACO chooses to use.

Similarly, under the QPP, clinicians must submit performance and quality reporting requirements as part of billing Part B Medicare. This is called the Merit-based Incentive Payment System or MIPS. For those in an MSSP ACO, there is some overlap of these requirements.

Under QPP, ACOs are divided into two categories: MIPS APM or Advanced APM. The level or track of participation dictates the version and thereby reporting requirements. An ACO in MSSP BASIC Track, Level A-D, is considered a “MIPS APM” under the QPP. Level E or ENHANCED Track participation is considered an Advanced APM because of the increased level of downside risk required by the model.

MIPS APMs (MSSP Levels A-D)

Under QPP, there are four MIPS performance categories required for reporting:

- Quality

- Cost

- Improvement Activities

- Promoting Interoperability

Each category is weighted to sum to 100%. For a MIPS APM, the four categories carry different weights than if the provider were not in an ACO: Quality 50%, Cost 0%, Improvement Activities 20%, and Promoting Interoperability at 30%.

Quality is calculated by the reporting requirements under the ACO. Therefore, if you submit quality as an ACO (via Web interface or eCQMs), it will be used to calculate the Quality category of MIPS. Cost is set at 0% and ACOs are given the full 20% for Improvement Activities just for sheer participation in MSSP.

Promoting interoperability (PI) is the wildcard. PI is the only category that must be reported by each individual ACO Participant Tax ID Number (TIN) or through the use of a third-party intermediary. ACOs do not report this category for the entire entity. This is because PI reporting is based on the electronic health record (EHR) being used by each group, which could differ across all the participants in an ACO.

PI requires the use of 2015 Certified Electronic Health Record Technology (CEHRT) to report. Data submitted to CMS must be of at least a 90-day continual period during the performance year. Therefore, if you are implementing a new EHR, determine which 90-day period would be the easiest to report on and let that help you determine implementation.

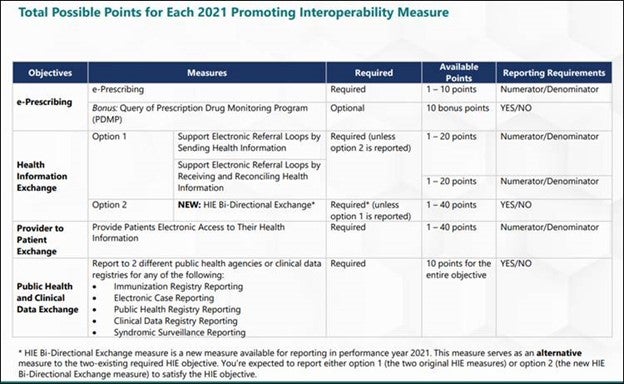

Next, review the measures for that performance year. In 2021, there were four objective categories of measures:

- e-Prescribing

- Health Information Exchange

- Provider to Patient Exchange

- Public Health and Clinical Data Exchange.

See the chart below for the requirements for the four objectives areas. Those in MIPS APMs must report PI as if they were in traditional MIPS, meaning as if they were NOT in an ACO.

After determining which measure to report, log into the QPP site to do your reporting. For those in an MSSP, the final submissions for each ACO Participant TIN will be aggregated and then weighted based on the number of providers. The larger systems or practices in the ACO will carry more weight than smaller ones.

Hardship Exception

There are a few hardship exceptions. Clinicians were able to apply for a hardship so that PI might be reweighted to 0% and the percentage redistributed to the Quality category. These applications were due on December 31, 2021. Exceptions include:

- Small practices (TIN or virtual group with 15 or fewer clinicians)

- Decertified EHR technology

- Insufficient internet connectivity

- Facing extreme and uncontrollable circumstances such as disaster, practice closure, severe financial distress, or vendor issues (this does not include the current Public Health Emergency (PHE) for COVID-19)

- Lack of control over the availability of CEHRT

MIPS APM clinicians who submit this hardship will still receive the PI score that the rest of the ACO receives, but will be removed from the calculation when they create the weighted average.

Extreme and Uncontrollable Circumstances Exception

In 2021, CMS applied the extreme and uncontrollable circumstances (EUC) exception due to the PHE as a separate exception application. This application reweighted all four QPP categories, not just PI. This application allowed ACOs to submit on behalf of the entire ACO but with some differences below to qualify. This application was due December 31, 2021:

- ACOs were required to request reweighting for all performance categories (not just PI)

- At least 75% of the MIPS eligible clinicians in the ACO need to qualify for reweighting in the Promoting Interoperability performance category

- Data submission for a MIPS APM won’t override performance category reweighting

Advanced APMs (Level E, ENHANCED Track)

Advanced APMs are treated somewhat differently. If the Advanced APM passes certain qualifying thresholds, the clinicians in the ACO are exempt from reporting MIPS, thereby alleviating the requirement to report PI. Passing these thresholds secures the 5% APM incentive payment for participating in a model that is taking on more than nominal downside risk.

QP Status

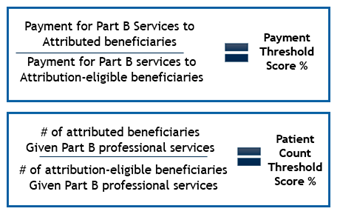

The thresholds are called Qualifying APM Participant (QP) Thresholds and are measured two different ways: patient count and payment amount. To become a QP, you must receive at least 50%of your Medicare Part B payments or see at least 35%of Medicare patients through an Advanced APM entity during the QP performance period.

Through this, CMS is determining what portion of the total traditional Medicare beneficiary population that was seen by the clinician was assigned to the ACO. Were more than 35% of the beneficiaries in the ACO? Or was more than 50% of your Medicare payments tied to an ACO beneficiary? If yes for either, then the QP threshold has been passed, and the ACO is exempt from MIPS.

Partial QP Status

If no, then the provider could be a Partial QP. Partial QPs can decide if they want to report MIPS. Their thresholds are lower. To become a Partial QP, you must receive at least 40%of your Medicare Part B payments or see at least 25%of Medicare patients through an Advanced APM entity during the QP performance period.

No QP Status

If these thresholds are not met, the Advanced APM now reverts to being a MIPS APM and must report on Promoting Interoperability.

Here to Help

CHESS understands that these regulations are everchanging and overlap can be complicated. If you or your practice have a question about MIPS reporting or specifically Promoting Interoperability, feel free to contact us for assistance.

About the Author